What is Return on Investment (ROI)?

Return on investment (ROI) is a ratio that measures the gain or loss generated from an investment relative to its purchase cost. It provides a clear and standardized way to assess the performance of different investments, making it easier to compare their viability and potential results.

ROI is a common metric in traditional finance (TradFi), as well as cryptocurrency trading.

Whether you’re a seasoned investor, a business owner, or simply looking to make informed financial decisions, understanding it is key.

How to Calculate ROI

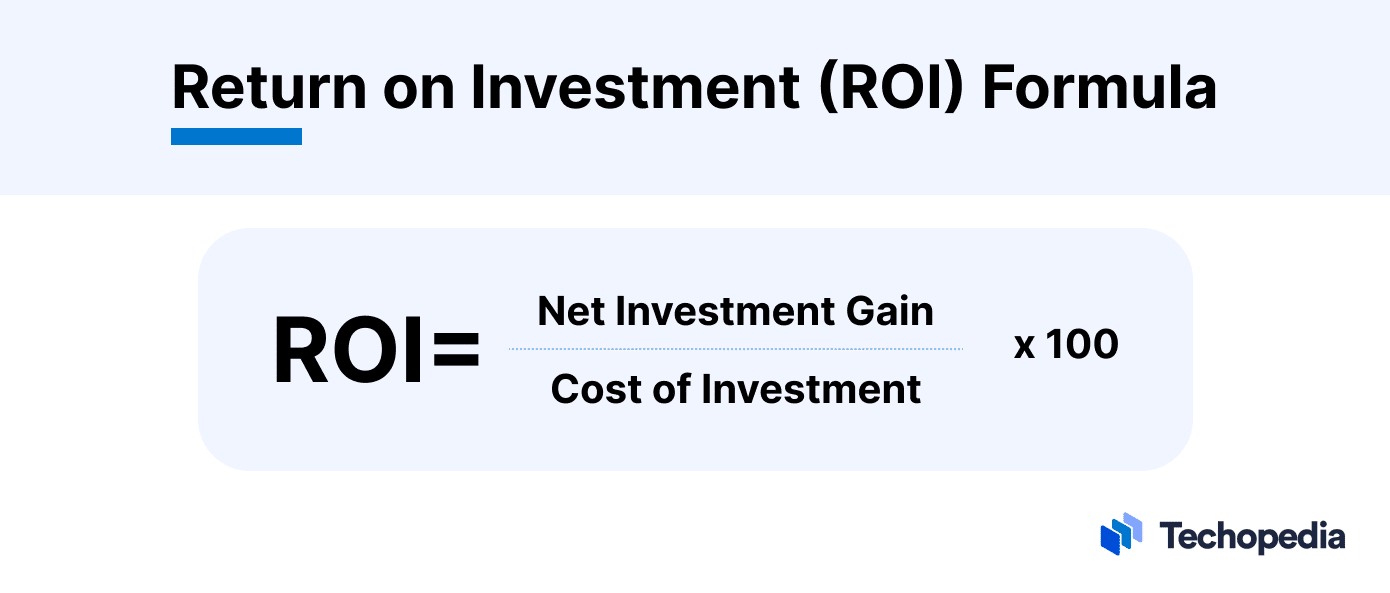

ROI is typically expressed as a ratio or percentage. The formula for a percentage is:

- Net profit – or net investment gain – refers to the total gain from the investment minus costs or expenses. It is essential to consider all costs, including initial investment expenses, maintenance, and taxes.

- Cost of investment refers to the total amount invested in the project or asset. This includes the initial purchase price, as well as any additional capital invested over time.

To take an example of ROI in the cryptocurrency market:

An investor buys 2 ETH at $1,500 each. The price rises to $1,800. They have an ROI of 0.20 or 20% on their $3,000 investment.

Interpreting ROI

ROI is a relatively straightforward metric to interpret:

| Concept | Insights |

| Positive vs. negative ROI | A positive ROI indicates that the investment is profitable, while a negative ROI suggests a loss. The higher the positive ROI, the higher the potential return. |

| Comparing investments | Investors should consider choosing an investment with the highest ROI depending on other factors such as risk and financial goals. |

| Timescale | ROI can change over time as investments evolve. Regularly tracking ROI helps investors adjust their portfolios and optimize returns. |

Why is ROI Significant?

Understanding ROI is important for several reasons:

- Assessing investment opportunities. ROI helps investors evaluate the potential returns of different investment options. By comparing the ROI of various options, investors can make informed decisions about asset allocation.

- Measuring performance. ROI helps investors gauge the potential success of an investment. A positive ROI points to a profitable investment, whereas a negative ROI indicates a loss.

- Risk management. ROI is a useful tool for assessing risk. Investments with a higher potential ROI typically carry a higher risk. Understanding the relationship between risk and return helps investors make decisions that align with their financial goals.

- Performance benchmarking. ROI helps investors benchmark the performance of an investment against industry standards or competitors to identify areas for improvement in their portfolios.

Limitations of the Metric

Investors should keep in mind that ROI has some limitations as a metric.

When comparing investments, one may appear to be more profitable, but it would be less efficient if it takes a longer time period to generate the return. For example, if a crypto trade took 12 months to reach a 60% ROI, it would be less efficient than a trade that took 7 months to reach a 50% ROI.

One solution to this is to consider annualized ROI to take the timescale into account.

The Bottom Line

Return on investment is a fundamental financial metric that helps investors evaluate and compare the potential profitability of investments to choose those with the highest potential returns.

Understanding ROI is key to making informed choices and maximizing investment profits.