What is a Bond?

A bond is a fixed-income financial instrument that represents a loan made by an investor to a borrower. A bond contract details the loan amount, interest rate, payment schedule, maturity date, and other important terms and conditions.

Bonds are issued by governments, municipalities, corporations, and other entities to finance their projects and operations.

When an investor buys a bond, they are lending money to the bond issuer. In return, they receive interest payments calculated based on a predefined rate and the full principal repayment at maturity.

Bonds are used to raise capital and are traded as over-the-counter securities most of the time.

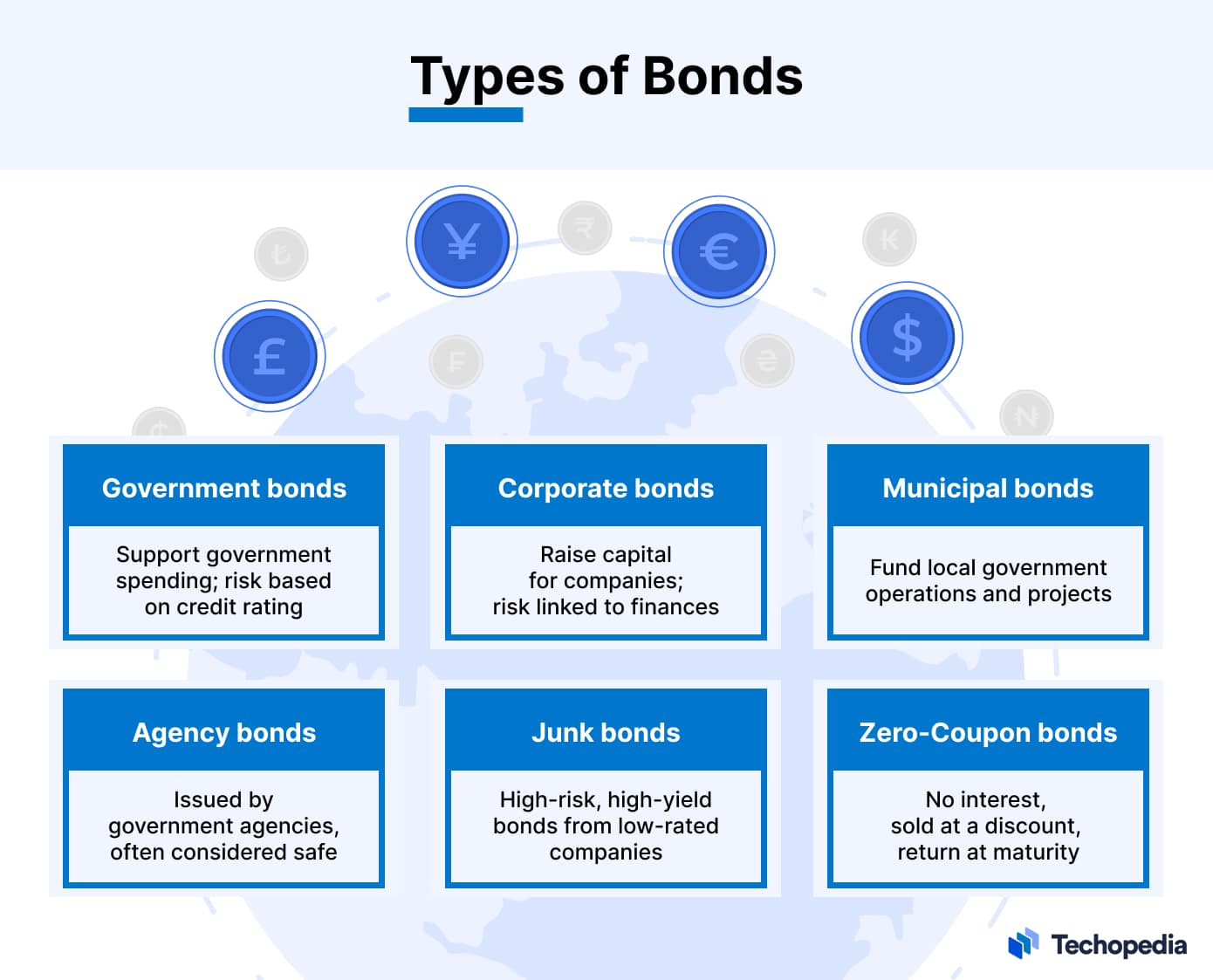

Types of Bonds

Bonds can be classified depending on the type of entity that issues them or how investors are compensated.

This is an overview of the most common categories of bonds out there:

- Government Bonds: Issued by the treasury department of federal governments and sovereign nations to support their spending needs and capital investments. Their risk is determined based on the credit rating of the issuing country.

- Corporate Bonds: Issued by companies to raise capital for general purposes or fund a specific corporate action like a merger or acquisition. Their risk depends on the company’s financial soundness.

- Municipal Bonds: Issued by states, cities, and local governments to fund their day-to-day operations and projects.

- Agency Bonds: Issued by government agencies like Fannie Mae or Freddie Mac in the United States. They are often considered investment-grade investments as long as they are backed by the federal government.

- Junk Bonds: Issued by companies with low credit ratings and weak finances. They offer higher yields to compensate for the additional risk assumed by investors.

- Zero-Coupon Bonds: Do not pay interest but are issued at a discount to face value. Investors earn money once they receive the bond’s principal payment.

Key Elements of a Bond

Bonds have various elements that investors analyze to determine if they are an attractive investment opportunity.

These are the most relevant factors to consider when assessing one of these financial assets:

Key Element

Description

Face Value

Also called par value. The amount repaid to the bondholder once the instrument matures.

Coupon Rate

This is the interest rate that the issuer must pay on the bond’s face value. Payments are usually made every quarter, although some instruments have semiannual or monthly payment frequencies.

Maturity Date

This is the date when the bond’s principal must be repaid to the bondholder.

Issue Price

The initial price at which the bond is first sold to investors. Bonds that are offered above their nominal value trade at a premium, while those that are offered below this threshold are sold at a discount.

Credit Rating

A letter that showcases the creditworthiness of the issuer and its risk of defaulting on debt payments. High-yield bonds have lower ratings, while investment-grade bonds are those issued by the soundest entities, such as the United States government.

How Do Bonds Work?

When an organization needs to raise capital, it can issue bonds that investors can purchase.

This is a summary of how bonds work:

- The investor lends money to the issuer by purchasing the bond. This provides capital to the company or organization.

- In return, the issuer makes periodical interest payments based on the instrument’s coupon rate and face value. Investors are compensated for assuming the risk of loaning money to the issuer via these payments.

- At maturity, the issuer fully repays the bond’s face value.

Bond investors take on the credit risk that the issuer may default and fail to fully repay the bond’s principal or even its interest payments.

The common perception is that the higher the issuer’s credit rating, the lower the odds that this may happen.

Types of Bond Yields

A bond’s yield refers to the investor’s rate of return. Some of the most common yield-related metrics used to analyze bonds include:

- Coupon Yield: It is the same as the coupon rate. It is expressed as a percentage of the bond’s face value. It reflects how much the investors would receive annually if the bond is purchased at par value.

- Current Yield: This is calculated by dividing the annual interest payment by the bond’s market price. It measures the expected annual return on investment.

- Yield to Maturity: This calculation expresses what would be the annual return an investor would earn, assuming that the bond is purchased at the current price and held to maturity.

Yields vary between bonds based on factors such as their credit rating, the remaining time until maturity, and the prevailing interest rates in the market. Bonds with longer maturities and higher levels of risk tend to pay higher yields.

Bond Prices and Interest Rates

Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices fall. When rates decline, bond prices increase.

For example, say a bond has a fixed 4% coupon rate. If the benchmark interest rate rises to 5%, no one will pay full price for the 4% bond when new bonds pay 5%. The price must decrease enough to make that lower yield attractive to market participants.

In addition, the longer the bond’s maturity is, the more sensitive its price will be to changes in the referential interest rate. Price volatility can impact investors who sell bonds before they mature.

Risks Associated with Bond Investments

There are two main risks to consider when investing in these fixed-income securities: credit risk and liquidity risk.

Here’s a brief description of what each of these risks means.

Credit Risk

Credit risk refers to the odds that the issuer of the bond defaults and fails to fully repay the instrument’s principal and interest. Rating agencies assess credit risk by assigning issuers a credit rating.

Investment-grade bonds have the highest ratings and are perceived to have the lowest credit risk compared to high-yield “junk” bonds.

U.S. Treasury bonds have the highest possible credit rating since they are backed by the full faith and credit of the U.S. government – a nation that has never defaulted on its sovereign debt in its entire history. Corporate and municipal bonds typically carry a higher default risk than government bonds.

Liquidity Risk

Liquidity risk is the risk of being unable to find a buyer to sell the bond at market value. Newly issued bonds are highly liquid. Older bonds traded over-the-counter (OTC) in secondary markets may face higher liquidity risks. Investors demand higher yields on less liquid bonds.

Some bonds have embedded call or put options that impact their liquidity. Callable bonds allow the issuer to repay the bond’s principal before the maturity date. Putable bonds allow investors to sell the bond back to the issuer before maturity under certain conditions.

How to Invest in Bonds?

Investors have several options to get exposure to bonds nowadays.

These are the four most common alternatives:

- Bond Funds: Mutual funds and exchange-traded funds (ETFs) that hold a portfolio of bonds. These funds charge an annual management fee and offer access to diversified portfolios of these fixed-income securities.

- Individual Bonds: Bonds traded in secondary markets or newly issued bonds that can be bought from underwriters or through a broker-dealer.

- Treasuries: These can be purchased directly from the United States federal government via TreasuryDirect or through a broker-dealer.

- Collateralized Debt: Structured products that pool various bonds into a single security. Some examples include mortgage-backed securities (MBS) or a collateralized debt obligation (CDO).

Bonds play an important role in investment portfolios by providing income, diversification, and lower volatility compared to stocks.

However, bonds still carry some degree of risk like interest rate, inflation, and default risk that investors must consider.

Advantages of Investing in Bonds

There are also some disadvantages associated with this type of investment that must be considered:

Advantages

Description

Stable Income

Bonds provide fixed interest payments at regular intervals. This provides a steady stream of cash flow to the investor.

Low Volatility

Bond prices are less volatile than stocks since regular coupon payments reduce the instrument’s volatility.

Diversification

Bonds often move independently of stocks. This lowers portfolio risk through diversification.

Capital Preservation

Bonds promise full repayment of principal at maturity, assuming no default. This helps preserve investors’ capital.

Tax Advantages

Certain municipal and Treasury bonds offer tax-exempt interest income. This enhances after-tax returns.

Liquidity

The bond market is gigantic, and a significant amount of capital flows in and out of it every day. This increases the liquidity of bonds and narrows down bid-ask spreads.

Higher Claim

In the event of bankruptcy, bonds carry a higher claim compared to stocks and other variable-income securities.

Disadvantages of Investing in Bonds

Disadvantage

Description

Interest Rate Risk

Bond prices fall when interest rates rise. This can lead to lower returns or capital losses if bonds are sold before their maturity date.

Inflation Risk

Inflation slowly erodes the purchasing power of a bond’s interest payments and principal. Real returns may be significantly lower than nominal returns when inflation is high.

Default Risk

Any bond carries the risk that the issuer may default and fail to repay a portion or the entire financial commitments associated with the instrument.

Opportunity Cost

Bonds may underperform stocks and other assets during certain periods. For example, when interest rates are low.

Early Redemption

Callable bonds introduce uncertainty regarding the holding period and total returns.

Lack of Upside

Unlike stocks, bonds do not offer any upside potential if the issuer’s business performs better than expected, as the interest payment will remain the same despite how corporate earnings behave.