2024 could be the year when Bitcoin (BTC) leads the broader cryptocurrency market into another crypto bull market. Bitcoin supply-demand conditions are aligned to take advantage of the upcoming Bitcoin halving event due in April 2024.

We could see a scenario where BTC supply abruptly drops amid a surge of institutional demand due to two key events – Bitcoin’s fourth halving event and the potential approval of Bitcoin exchange-traded funds (ETFs).

In this article, we will look at the possibility of a Bitcoin bull run purely from a supply-demand point of view for the cryptocurrency.

Bitcoin Bull Run 2024: BTC’s Shrinking Supply

1. Bitcoin Halving

Sometime in April 2024, Bitcoin is expected to undergo its fourth halving cycle, after which the number of Bitcoins minted with each block will reduce by 50% from 6.25 BTC to 3.125 BTC.

Bear in mind that newly-minted coins first hit the coffers of Bitcoin miners. Bitcoin mining is a capital-intensive operation that forces miners to sell a chunk of their BTC income to cover operational expenses. Therefore, the market supply of BTC will not shrink immediately following the halving.

READ MORE:

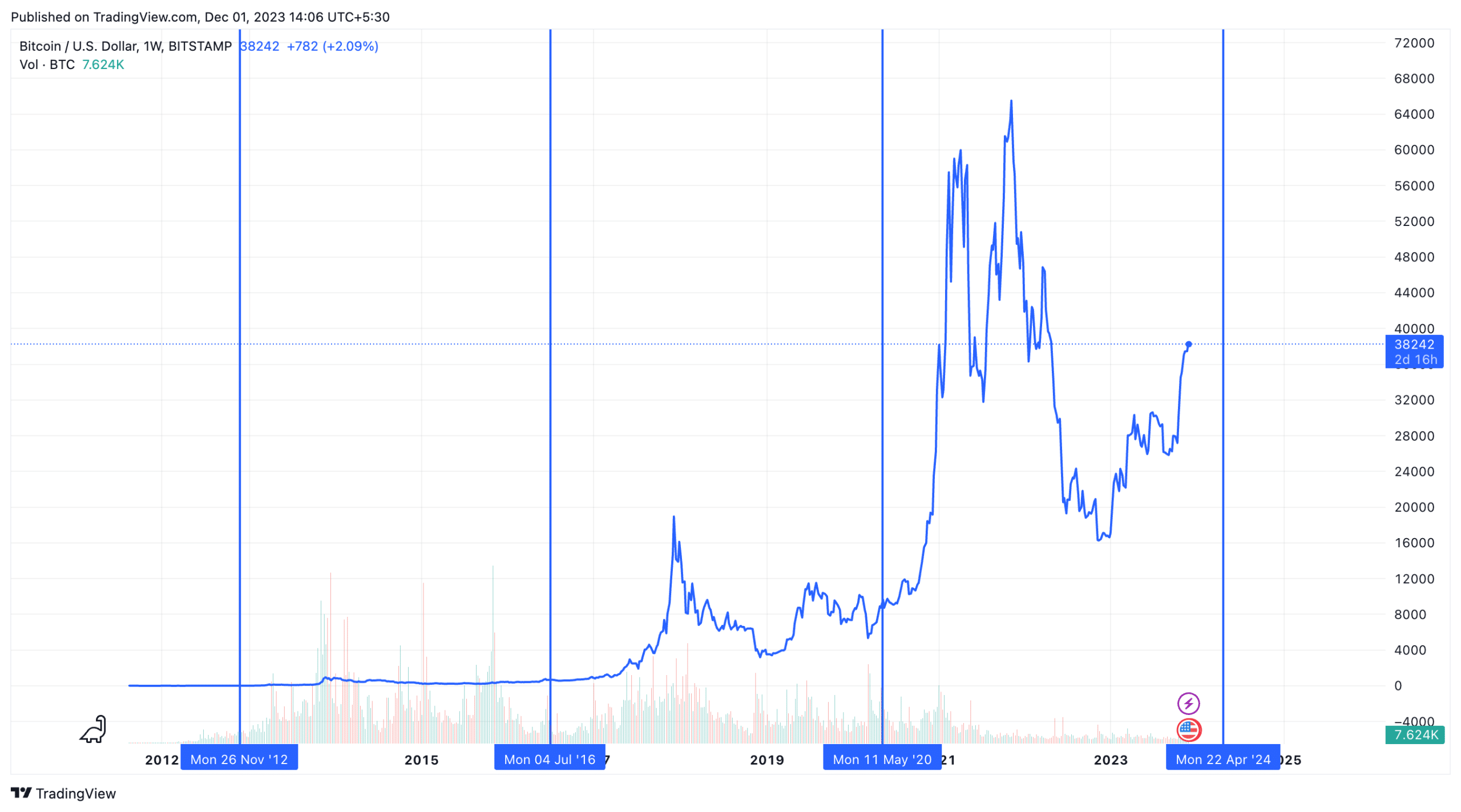

A look at historical BTC/USD charts showed that Bitcoin traded rangebound for a couple of months before breaking out into a bull run, following the second Bitcoin halving event in July 2016 and the third Bitcoin halving event in May 2020.

A similar brewing phase can be expected in 2024 when the mining community adjusts to the reduced mint supply, and periodic price spikes reignite the fear-of-missing-out (FOMO) feeling among investors.

2. Investor Accumulation

The present-day crypto market is more informed and prepared than it was in the lead-up to past halving events. It comes as no surprise that Bitcoin investors are accumulating coins to take advantage of the 2024 halving event.

In this regard, Michael Saylor and his publicly-listed firm, Microstrategy, are leading the way. The firm acquired an additional 16,130 BTC at an average price of $36,785 per BTC in November 2023. At the time of writing, Microstrategy held 174,530 BTC, accounting for nearly 0.9% of BTC’s circulating supply.

READ MORE:

It’s not just the whales that are accumulating BTC. Blockchain data compiled by Glassnode suggested that wallets of all sizes are looking to HODL Bitcoin. According to a November 2023 report by Glassnode, long-term holders’ (wallets that hold BTC for over 155 days) supply is nearing an all-time high, while short-term holder supply is close to an all-time low.

The #Bitcoin Supply is historically tight, with an all-time-high in coins held by Long-Term investors, and impressive rates of accumulation taking place.

Discover more in the latest Week On-Chain👇https://t.co/3wTXOHoRmd pic.twitter.com/f6nf30Nld7

— glassnode (@glassnode) November 7, 2023

Bitcoin’s Increasing Demand

We will focus on institutional demand for Bitcoin. Institutional capital’s role in helping the crypto market hit record levels in November 2021 cannot be understated.

1. Bitcoin ETF

Yes, Bitcoin ETFs will make it easier and safer for retail investors to get exposure to BTC. But it’s the big fat cheques from traditional finance wealth management houses and investment banks that the crypto market is looking forward to.

So far, institutional investors have shied away from cryptocurrencies due to the lack of regulatory clarity, liquidity issues, and tracking inefficiencies. If a Bitcoin ETF is approved, investment houses and hedge funds will get a safe, reliable, and regulated tool to access the Bitcoin market.

According to Galaxy Digital Holdings, as of October 2023, the total value of assets managed by US broker-dealers, banks, and registered investment advisors stood at $48.3 trillion. That is nearly 64 times the market cap of Bitcoin, which stood at about $0.755 trillion at the time of writing.

Galaxy Digital estimated that the US wealth management industry alone could channel $14 billion into Bitcoin ETFs in the first year of its launch, assuming that “BTC is adopted by 10% of total available assets in each wealth channel with an average allocation of 1%.”

Eric Balchunas, senior ETF analyst at Bloomberg, tweeted that there was a 90% chance of approval for a Bitcoin ETF by 10 January 2024.

People asking me if we changed odds. No, we still holding line at 90% odds of approval by Jan 10 (aka this cycle), the same odds we've had for months (before it was cool/safe). What we watching for now: more amended/final filings to roll in and clarity on in-kind vs cash creates https://t.co/uiWgfxOfzz

— Eric Balchunas (@EricBalchunas) November 29, 2023

2. Increasing Investor Appetite

Let’s discuss two market metrics indicating rising institutional investor appetite for Bitcoin.

- Asset managers’ BTC long futures open interest hits an all-time high.

On 30 November 2023, The Block reported that open interest in Bitcoin long futures held by asset managers hit an all-time high of $1.98 billion. The previous record stood at $1.67 billion, which came during Bitcoin’s bull run rise to its peak of $69,000 in November 2021.

Interestingly, in November 2023, the CME exchange pipped Binance to become the most dominant Bitcoin futures trading platform in terms of open interest. Institutional investors prefer to trade in the crypto derivatives on CME as it is considered to be more compliant to market regulations than its rivals.

CME #Bitcoin open interest reached 118.54K #BTC($4.42B), a new all-time high.(coin)

👉https://t.co/b1RbJ1A35P pic.twitter.com/mZN43aK3Yt

— CoinGlass (@coinglass_com) November 27, 2023

- Narrowing Grayscale Bitcoin Trust discount

The Grayscale Bitcoin Trust (GBTC) is the closest thing we have to a Bitcoin ETF. For the longest time, the GBTC has been trading at a discount, hurt by the crypto bear market, parent company bankruptcy risks, and rejection of its ETF conversion. At one time, GBTC was trading at a record discount of about 50% to its net asset value (NAV).

As of 1 December 2023, the GBTC discount to NAV has narrowed to 10.6%. GBTC’s recovery underscores the change in investor sentiment for the multi-billion dollar trust, whose top shareholders include Cathie Wood’s ARK Investment and several Morgan Stanley mutual funds.

1/ $GBTC discount to NAV at narrowest since July 2021

According to data from @ycharts , the discount of GBTC, @Grayscale’s Bitcoin Trust, has reached -8.06%, the narrowest figure since July 2021. pic.twitter.com/CQxFSBmfaO

— Binance Research (@BinanceResearch) November 27, 2023

The Bottom Line

Financial markets are unpredictable. The chaotic price movements can humble even the smartest and most experienced players. This article merely takes a punt on the basic economics principles of supply-and-demand and fear-and-greed playing out in predicting a crypto bull run in 2024.

Having said that, predictions can be wrong. This article should not be considered investment advice and is for information purposes only. Always conduct your own diligence.