What is an Asset Class?

An asset class brings together assets that meet the same criteria. It can be in terms of regulations, structures, or where and how they are traded.

Investors and experts use these classes to sort different assets based on how risky or rewarding they are, their investment features, and other traits.

Each asset class is a big group of financial tools, and they help investors mix things up in their investment collections to spread out risk.

Sometimes an asset class can include assets that are also categorized within other classes. This mostly depends on what the particular investor trading the asset considers cross-boundary assets.

Some examples of regulatory authorities for asset classes include the Australian Securities and Investments Commission (ASIC), as well as the UK Financial Conduct Authority (FCA).

Examples of Asset Classes

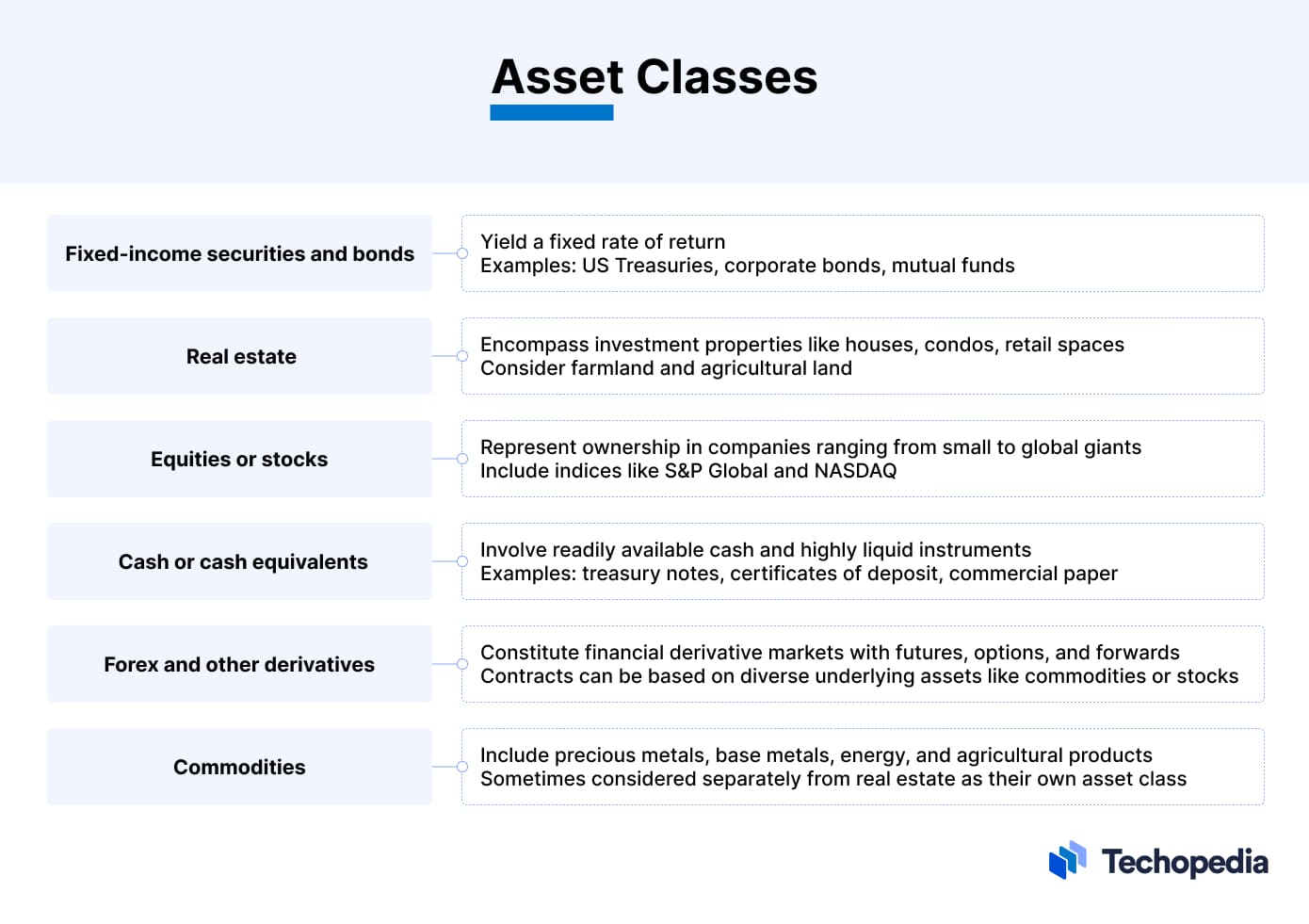

There can be several asset classes, depending on type, definition, and interpretation. However, broadly, assets are grouped into five classes, as highlighted below:

- Fixed-Income Securities and Bonds: These are any securities that yield a fixed rate of return, such as US Treasuries, corporate bonds, mutual funds, and so on.

- Real Estate: This can include investment properties such as houses, condos, apartments, retail spaces, warehouses, and other rental properties. Sometimes, farmland and other agricultural land can also fall into this category.

- Equities or Stocks: Equities include various company stocks, ranging from small and mid-range to global giants, such as Apple, Meta, or Alphabet. Equities are one of the most common assets held by investors across the board. Indices such as the S&P Global and NASDAQ also fall within this category.

- Cash or Cash Equivalents: This includes simple cash, which is widely available, as well as other types of highly tradeable and liquid instruments. These can be treasury notes, certificates of deposit, and commercial paper, amongst others.

- Forex and Other Derivatives: Foreign exchange is another extremely popular and liquid asset. Financial derivative markets, such as futures, options, and forwards, also have a number of players. These types of contracts can be based on a number of underlying assets, such as various types of commodities or stocks.

- Commodities: Although commodities are sometimes clubbed into the same category as real estate and together called real assets, several investors see them as their own class. This is because commodities can be very diverse. Precious metals, base metals, industrial metals, energy, agricultural products, and livestock all come under commodities.

Why are Sub-Asset Classes Important?

Sub-asset classes are further breakdowns within the broader asset categories. This helps investors have more specific knowledge and access to the kind of assets that most interest them.

This is especially necessary as some asset classes can be extremely broad. As such, they would not provide much value to investors if we always club them as a whole.

For example, commodities can be broken down into metals, energy, livestock, and so on.

However, a metals trader or investor may have very little knowledge or interest in trading energy or livestock. As such, distinctions within asset classes, as well as separate exchanges or indices to trade them on, are very useful.

Equity sub-asset classes can be small-cap, mid-cap, and large-cap. We can further classify them according to geographical presence, such as US equities or European equities. Similarly, we can divide them into individual indices, such as the UK100, CAC40, or S&P 500.

Some investors may be interested in only investing in indices and not individual stocks. This is especially true if they prefer a more long-term and low-risk strategy.

Coming to fixed income, sub-asset classes are:

- High-yield bonds

- Treasury bonds

- Zero-coupon bonds

- Corporate bonds

- Municipal bonds and much more

Asset-backed securities and mortgage-backed securities are also fixed income sub-asset classes. These bonds will have different maturity dates, coupon rates, and prices. They will also carry varying levels of risk.

Treasury bonds are the safest, whereas high-yield or junk bonds are the riskiest, however can give more returns.

Exploring Alternative Assets

Alternative assets are investments that are not part of any of the other traditional asset classes. These include collectibles such as vintage cars and motorcycles, art, watches, stamps, and wine, amongst others.

Some investors also consider real estate and cryptocurrencies to be alternative assets. Private equity, hedge funds, and venture capital are also alternative investments.

Balancing Risks and Rewards

Alternative assets can go a long way in reducing certain types of risks in investment portfolios. These include risks arising from market volatility, as well as uncertain foreign exchange or domestic currency movements.

Seasoned alternative investors can also sometimes find ways to make more profits from alternative investments than other asset classes.

However, this is not to say that alternatives don’t have their own share of risks. The initial capital investment required can be out of reach for many investors. Adding to this are other fees, depending on where the asset is stored, traded, and how it is acquired.

It can also be quite difficult to find buyers for many alternative investments when the time comes. This is due to several considerations, such as the buyers also having to have enough capital to buy the asset.

Furthermore, in some cases, special licenses may be required to trade certain assets, which fewer buyers may have.

Adding to the mix is unclear and insufficient regulations governing and protecting most alternative investment markets. This can mean that a lot of novice investors end up losing more than they can afford to.

Some portfolio managers are helping considerably with knowledge and education of alternative investments. This helps reduce the amount of losses somewhat, especially if only a certain percentage of a portfolio is allocated to alternatives. However, this optimum percentage varies between portfolio managers.

How Does Inflation Affect Various Assets?

Inflation impacts different asset classes differently. This is why a number of investors choose to hold various asset classes at the same time to minimize the effects of inflation. For the most common class, stocks, inflation can have a complex and multi-layered impact.

Let’s consider several examples of how inflation affects various assets:

- As costs increase, inflation can affect input materials, as well as labor prices. As such, it can take a toll on corporate profit margins, which can lead to stock prices falling.

- Inflation also has an impact on broader consumer sentiment. Investors usually consider stocks one of the riskier asset classes during inflation, which may reduce interest.

- However, precious metals like gold and silver do relatively well during times of high inflation. This is because they are safe-haven assets, and their value increases in US dollar or other fiat currency terms in times of inflation. Rising interest rates or similar also do not impact precious metals very much. Since they are physical commodities, with a limited supply, unlike fiat currencies, investors consider them stores of value.

- Inflation does impact the price of other commodities, such as agricultural products, somewhat. This is especially true when manufacturers use them to produce other goods and pass on the costs to final consumers. However, they are still less impacted than stocks.

- For fixed-income securities, as well as cash and equivalents, inflation basically erodes the value of currency, and by extension, of returns. This is especially true if the inflation rate is higher than the rate of return for these investments, which it often is.

- Similarly, as inflation undermines the strength of currencies, it also has a volatile effect on foreign exchange markets.

Diversification Across Asset Classes

Investors often use a combination of different asset classes, such as stocks, commodities, or real estate, to diversify against risk.

These risks mainly arise in the form of three types:

- Market

- Liquidity

- Credit risks

Sometimes large organizations can also face liquidity risks as they depend on selling a portion of their assets to pay off loans. However, if the assets don’t sell on time, the entity may have issues paying off its debts. Examples of credit risks include defaulting on credit card payments, mortgages, or invoices. It also includes a company being unable to pay employee salaries and suppliers for goods and services provided.

Risk Type

Description

Market Risks

Risks that can impact an entire sector or global markets as a whole. These include fluctuations in equity or commodity prices, as well as foreign exchange or interest rates. Natural disasters, terrorism, war, weather events, and inflation also come under market risks.

Liquidity Risks

Risks that can arise when an investor or trader faces difficulty selling an asset quickly due to cash flow problems or a limited number of market participants.

Credit Risks

The risk of an entity (individual, company, or country) being unable to repay its dues, leading to financial instability and potential default.

Fairly conservatively, a portfolio should dedicate about 15% to 20% to alternative investments or different asset classes. This would hedge an investor somewhat from the above risks while also not diluting the core essence or investment strategy of the portfolio.